MWF (Monday) Links:

Unusual swings in cotton prices that disrupted farmer sales in March of this year are under investigation by the Commodity Futures Trading Commission(CFTC). Bloomberg They are in the process of drafting legislation for changes in regulation. Last week, the CFTC announces new rules to increase transparency and oversight over concerns of oil price fixing. Sagefield Post

Congress debate on climate change centers on costs. From higher electric bills to more expensive gasoline, the possible economic cost of tackling global warming is driving the debate as climate change takes center stage in Congress. Wired

Nice visual of the Seven Assets Risk Management article Sagefield had up May 26.

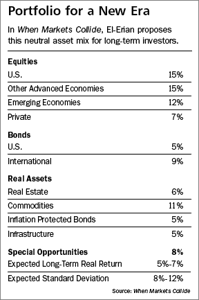

Table from Seeking Alpha and Barron's interview with Mohamed El-Erian from PIMCO.

Global Investment strategies during Stagflation. The current U.S. mess is going to take two years to clean up, and that implies a 40% market drop. Thus, fear has replaced greed as the basic investment strategy. Yen, Euro and Australian Dollar will be strong. Due to BRICs, the commodities are in a long bull run period. Lastly, keep money in short term instruments. For stocks, it should be commodities related. Enzio's Clock

Robert Roech by client request created one of the first credit derivativesabout a decade ago. Now he tries to help clients extricate themselves from the current derivatives based mess. FT

Robert Roech by client request created one of the first credit derivativesabout a decade ago. Now he tries to help clients extricate themselves from the current derivatives based mess. FT

Advancing the idea of energy conservation and efficiency and the types of companies that benefit most from that shift is more powerful that pursuing alternative energy. Hard Assets Investor

Moody's Implied Ratings Show MBIA, Ambac Turn to Junk. Bloomberg

Wheat Rust Hard Assets Investor & WSJ should add more price pressure on the rising demand for those commodities in emerging markets. There is a growing black market for grains in India using the porous Nepalese border to stockpile grains TOI

Consumers use tax rebates for bills and gas and not on new spending. NYT

More oil inventory revision. US crude oil inventories revised to 300,000 barrels this week from last week's ending level of 320.4 million barrels. Hard Assets Investor &

The knowing doing gap. There's an assumptive that there's cognition there in the first place. The Financial Philosopher

No comments:

Post a Comment

Hello, Please