by Fern Phan

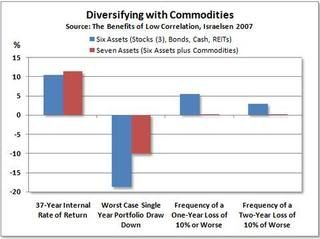

Only Commodities & REITs added the most portfolio diversification benefit among combinations of seven asset classes according to Professor Craig Israelsen in his article The Benefits of Low Correlation. Journal of Indexes, Nov/Dec 2007.

Commodities has low correlation to the core assets of U.S. large cap and small cap stocks and developed markets international equities. Adding more equities to an equity portfolio will only create more correlation. They all move in the same direction and have similar drawdowns. Cash and bonds might be good diversifiers, but they don't have attractive long-term returns. The real benefit comes when you add commodities. They have equity-like returns, but low correlations ... and in one important way, they have lower risk (less drawdown) than equities.

Commodities decreases volatility. Drawdowns is an indicator of risk. It’s used most widely by Commodity Trading Advisors (CTAs) where performance is measured. It’s the measure of maximum decline from a peak in a variable. It’s significant for commodities since according to Israelson, over the long term, adding commodities to a mixed asset portfolio reduces the worst one year drawdown.

Low correlation of commodities reduces risk by avoiding a portfolio where there's a high correlation (all assets move in sync in up markets and down markets) in performance between different asset classes within a portfolio.

On data Israelsen re/constructed going back to 1970 – large cap U.S. stocks, small cap U.S. stocks, non U.S. stocks, bonds and cash, a typical portfolio, you get a 10% internal rate of return while sustaining retirement withdrawals. The worst one-year drawdown since 1970 is 17%.

- Large-cap U.S. equities

- Small-cap U.S. equities

- Non-U.S. equities

- U.S. intermediate-term bonds

- Cash

According to Israelsen’s finding, adding REITs and commodities, the internal rate of return rises to 11.3%. More importantly, worst one-year drawdown falls to 10%, a 40% reduction.

- REITs

- Commodities

An 1.3% increase in the annual return. But a 40% reduction in the worst one-year drawdown is obvious. The irony is that commodities are seen as being volatile. That’s not the case in a long term scenario – it’s less volatile than stocks.

Seeing commodities in this new light makes it an extremely attractive asset class to add – even to the most conservative portfolios.

No comments:

Post a Comment

Hello, Please